The US Chamber of Commerce accused Democrats of using accounting “gimmicks” to conceal more than $1 trillion in spending in President Biden’s Build Back Better social-spending bill. It warned lawmakers not to vote on the package until they know its “true cost.”

“We have the highest inflation in 31 years, employers are struggling to fill a record number of job openings, and the current draft of the reconciliation bill uses gimmicks to cover up well over $1 trillion in spending,” chamber executive vice president and chief policy officer Neil Bradley said in a statement Wednesday.

“It would be the height of irresponsibility for Members of Congress to vote on this multi-trillion-dollar tax-and-spend bill with no clear understanding of its true cost or the real-world impact of the policies,” he added.

House approved a bipartisan and Senate-approved $1.2 billion infrastructure deal last week. However, the House is holding the $1.75 trillion spending bill while Democratic members wait for analysis by the nonpartisan Congressional Budget Office.

A letter from the chamber was sent to all members of Congress. It noted that the Build back Better legislation contains provisions that could be extended in the future Congress. This significantly increases the bill’s cost potential.

“As currently drafted, the reconciliation bill would expand or create new entitlement programs and refundable tax credits, but then sunsets many of these programs — in some cases after just one year — to disguise the true cost of the bill,” the letter said.

“Given that the bill’s proponents clearly intend for these programs to continue past their sunset, lawmakers should be provided with a Congressional Budget Office estimate of the true cost of the bill if these programs were permanent,” it continues.

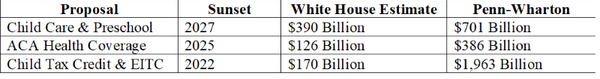

The chamber cites universal child care and pre-school as the problem programs. It also cites an expanded version and expiration of the child’s credit. Next year, the child tax credit will be eliminated. They also cite the reduction in premiums for Americans who buy health care through the Affordable Care Act’s marketplaces. This provision will expire in 2025.

“Experts at the Penn Wharton School at the University of Pennsylvania have estimated that if these programs were made permanent, the actual cost of the spending included in the bill would be $4.1 trillion,” the letter warned.

The chamber complained that some parts of the bill “frontload spending in the first part of the 10-year window” as set out by lawmakers.

“For example, over $20 billion is provided for workforce training and related education programs, but most of that money is only available through 2026,” the letter said. “A true accounting of the bill’s cost requires identifying which provisions are intended to be permanent and calculating the cost without any arbitrary sunset.”

The chamber called for greater transparency regarding how the bill would impact inflation and worker shortages.

“Today, a labor shortage crisis is one of the biggest factors holding back an economic recovery. Employers, especially small businesses, report unprecedented difficulty in filling open positions. Yet, there is no analysis of how the reconciliation bill would impact labor force participation,” it said.

“Some provisions, like childcare assistance, could, if structured correctly and not arbitrarily sunset, increase workforce participation while other provisions that increase transfer payments without requiring that recipients work will dampen participation,” the letter said.

Over objections from Sens and moderate House Democrats, Democrats have attempted to lower the bill’s size from its original $3.5 trillion price tag. Joe Manchin (D-WV), and Kyrsten Sinema, (D-Ariz.). Many Democrats also expressed the hope that Americans would become used to these programs and press Congress to make them permanent.

On Wednesday, the CBO released reports on four sections of the bill, which were contributed by the House Homeland Security, Science, and Veterans Affairs Committees. It stated that the bill “would not increase in on-budget deficits thereafter 2031,” but noted that a complete report will take longer.