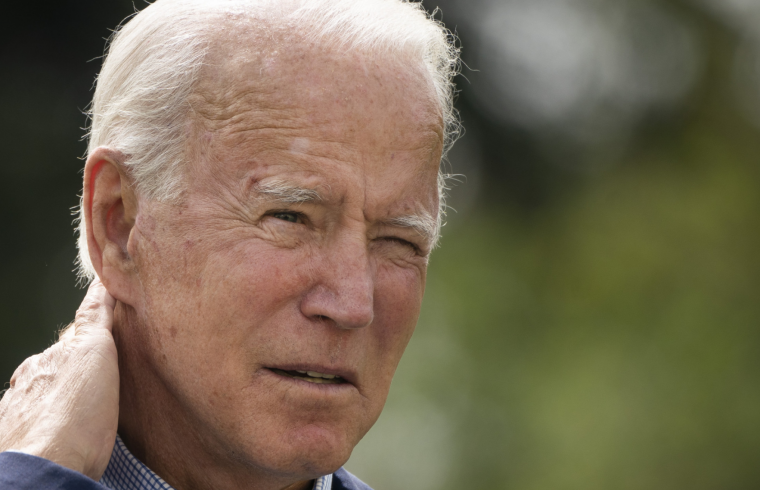

President Biden reiterated his assurance that no American earning less than $400,000 wouldn’t pay”a single penny” in extra taxes with a small twist on Monday after he suggested several tax increases to fund two sweeping spending strategies.

Biden seemed to mistakenly leave out a keyword during his address at Tidewater Community College — rather saying that nobody earning under his designated threshold would pay any taxes.

Last week, Biden introduced his $1.8 trillion American Families Plan, which focuses on education and child care.

He declared the American Jobs Plan, a $2 trillion investment that includes a revamp of the country’s infrastructure in addition to various child care suggestions.

Both spending strategies rely on tax hikes on companies and the wealthy for financing.

The American Jobs Plan includes an increase in the corporate tax rate to 28 percent from 21%, demonstrating a global minimum tax of 21% and removing various perceived loopholes in the corporate tax code.

The second proposal comprises numerous increases on individuals and families, notably increasing the top personal income tax rate to 39.6% from 37%.

The proposal would raise the capital gains tax rate for people earning more than $1 million to 39.6%, bringing it in line with the projected top individual tax rate. Presently, short-term capital gains are taxed at the same prices as earnings, but long-term gains are taxed at reduced prices.

Furthermore, Biden wants to get rid of the stepped-up basis provision, which enables an individual who inherits property or assets from a decedent to sell it instantly and pay no tax. That’s because the cost basis was”stepped up” in the cost the deceased owner originally paid for this to its fair-market worth on the date it was inherited.

Both plans mean huge tax hikes.